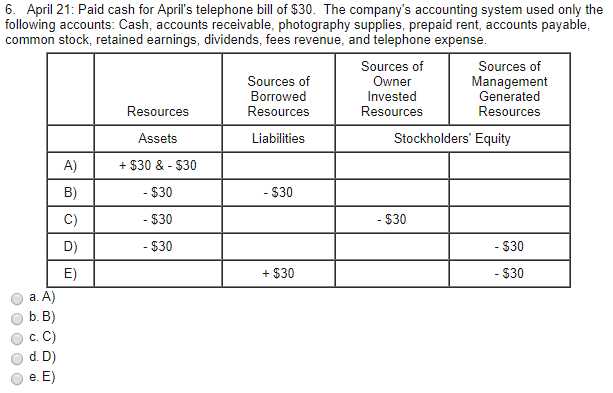

Telephone expense is the cost that company spends on the landline, phone service, or other phone usages during the accounting period. According to the accrual concept of accounting, expenses are recognized when incurred regardless of when paid. Therefore, if no entry was made for it in December then an adjusting entry is necessary. Okay, now that we’ve worked out which accounts are affected and the impact on the basic accounting equation, let’s tackle the debit and credit journal entry. As you can see above, the owner’s stake in the assets of the business (i.e. owner’s equity) decreases by $200 to $25,800. Remember that the term accounts payable refers to the value of debts to our suppliers for goods and services we have received but not yet paid for.

Journal in Financial Accounting

J) George Burnham pays the amount owing to the telephone company on the 13th of May. Ensure we record amounts accurately and choose appropriate GL accounts to journalize the transactions. Finally we are going to add administrative expenses to Income statement – they increase by 150. Keeping track of all of your business transactions shows you how cash flows in and out of your company. Using the direct method, when you realize an accounts receivable account is uncollectible, you write off the amount to bad debt. While this might seem like a small distinction, accounting and financial statements are all about the details.

Our Services

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. After the trial balance had been drawn up, the December bill arrived, which was for $870. Petty cash is an account of cash that’s usually kept on hand and used for small purchases, like office supplies. In business, doubtful accounts refer to any amount that you don’t expect to collect. Typically, you record depreciation at the end of the year to show how much value the long-term assets have lost during the year.

How do you record the “Paid Cash for telephone bill” transaction?

But what happens for expenses that you’re incurring but don’t know how much the cost will be? For example, for electricity, you’re billed after the fact based on the amount paid telephone bill journal entry you use. You’ll create another entry on Feb. 10 when you pay the invoice. Let’s say that you bought $1,000 worth of office supplies and you pay the vendor the same day.

Create a Free Account and Ask Any Financial Question

- Bills payable are the physical bills of sale that request payments by a certain date.

- After the trial balance had been drawn up, the December bill arrived, which was for $870.

- Depreciation is an accounting tool businesses use to record the loss in value of physical assets (like vehicles or machinery) over time.

Interest and salary expenses are accrued because the date that these items are paid does not necessarily correspond to the last day of the accounting period. For example, interest is often paid on a monthly or quarterly basis, while salaries are normally paid at regular intervals for work completed within the given period. The primary step in recording transactions is to familiarize yourself with the business and the nature of the trade and learn the accounting rules to apply for a specific transaction. Depreciation is an accounting tool businesses use to record the loss in value of physical assets (like vehicles or machinery) over time. It’s recorded on financial reporting documents, like balance sheets and income statements.

You are reducing the cash asset, so you are going to credit cash. In the example below, assume we issue payments for both of the bills in our previous journal entries. Another common term used instead of accounts payable is creditors. When the company makes the payment, they have to reverse the accounts payable and cash out. Telephone bill is a statement sent by a service provider to a customer that lists the charges for the services used.

This way, your monthly expenses take rent into account, even if you paid for it ahead of time. For instance, say you have a customer with an outstanding bill worth $1,000. If that customer goes out of business and can’t pay the bill, here’s how you’ll record that expense using the direct write-off method. In the above example, the note and the interest are paid quarterly. The interest is based on the previous outstanding principal balance of the note. At the beginning of the new period, the company has to reverse this transaction and wait for the actual invoice from the supplier.

This GL is a Liability account, and it’s part of a Personal Account. Finally, the adjusting journal entry on 31 December 2017, along with the entry to record the payment of salaries on 4 January 2018, is given below with T accounts. Therefore, accrued salaries payable must be recorded for salaries earned by employees but that are unpaid through the end of the accounting period. When ABC receives telephone invoices, they have to record telephone expenses and accounts payable. The journal entry is debiting telephone expense $ 500 and credit accounts payable $ 500.

You will also credit Telephone Expense for $20 when you record the $20 receipt from the employee. While you don’t need to make an accounting entry when you spend petty cash, you do need to record an entry when you move money from your cash account to the petty cash account. In that case, you can use accrued expenses (also known as accrued liabilities) to record unpaid expenditures that you have to estimate, such as your utilities or income taxes. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The salaries for the next 4 days of the week, or $1,200, are the expense of the next year, 2018. An adjustment must be made on 31 December 2019 to record the interest expense that was incurred between 1 October 2019 and 31 December 2019.

For simplicity’s sake, also assume that the firm began operations on Monday 2 January 2017. Finally, the journal entry on 2 January 2020 reflects the second payment of principal and interest. It is common for bills to be received after the end of the year, which actually relate to a service received before the year-end. First, understand the accounting rules, figure out the nature of the accounts and apply the rules.